The 6-Second Trick For Real Estate Reno Nv

Real Estate Reno Nv Fundamentals Explained

Table of ContentsA Biased View of Real Estate Reno NvReal Estate Reno Nv Can Be Fun For AnyoneThings about Real Estate Reno NvOur Real Estate Reno Nv StatementsThe Definitive Guide for Real Estate Reno NvThings about Real Estate Reno Nv

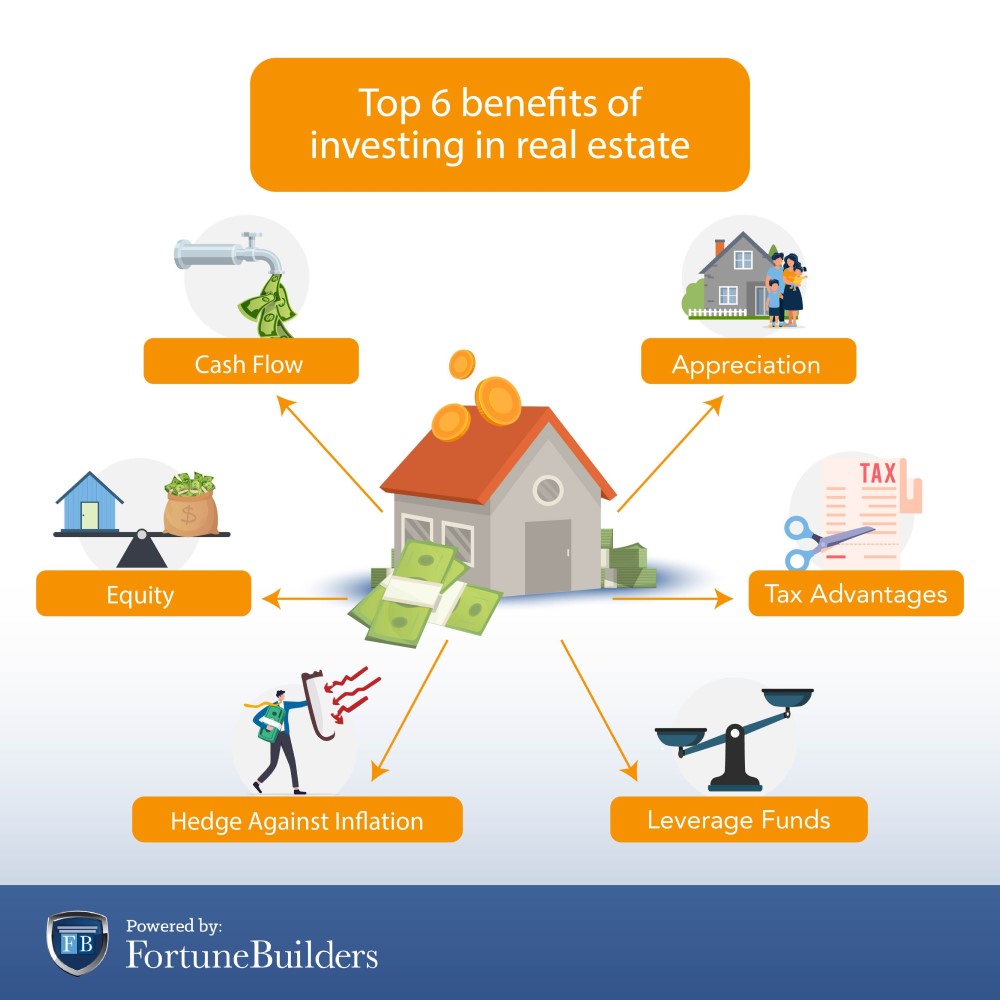

The benefits of buying actual estate are many (Real Estate Reno NV). With well-chosen assets, financiers can take pleasure in predictable money circulation, excellent returns, tax benefits, and diversificationand it's feasible to leverage property to build wide range. Considering purchasing property? Below's what you need to learn about property benefits and why actual estate is thought about a good investment.

The advantages of purchasing genuine estate include passive income, stable capital, tax obligation advantages, diversity, and utilize. Genuine estate investment company (REITs) provide a way to purchase actual estate without needing to possess, run, or money residential properties. Capital is the earnings from a property financial investment after home loan payments and operating expenditures have been made.

Realty values tend to boost over time, and with a great financial investment, you can make a profit when it's time to market. Rental fees additionally tend to increase over time, which can lead to greater money flow. This graph from the Reserve bank of St. Louis shows mean home costs in the U.S

Real Estate Reno Nv Fundamentals Explained

The areas shaded in grey show U.S. recessions. Median Prices of Residences Cost the USA. As you pay down a residential or commercial property home mortgage, you construct equityan asset that becomes part of your total assets (Real Estate Reno NV). And as you build equity, you have the leverage to get even more residential or commercial properties and raise cash money flow and wide range much more.

Realty has a lowand in some situations negativecorrelation with other significant asset courses. This means the addition of realty to a portfolio of diversified assets can lower profile volatility and supply a higher return each of danger. Take advantage of is making use of various financial instruments or borrowed resources (e.

Excitement About Real Estate Reno Nv

As economic situations expand, the demand genuine estate drives rental fees higher. This, consequently, equates into greater capital values. Genuine estate has a tendency to keep the purchasing power of capital by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the kind of funding admiration.

There are numerous manner ins which possessing actual estate can protect versus rising cost of living. Initially, home worths may increase more than the rate of inflation, resulting in look at this now funding gains. Second, leas on financial investment homes can raise to stay on par with inflation. Residential properties funded with a fixed-rate car loan will see the loved one quantity of the month-to-month home mortgage settlements fall over time-- for instance $1,000 a month as a fixed repayment will end up being much less challenging as inflation deteriorates the buying power of that $1,000.

Regardless of all the benefits of spending in genuine estate, there are drawbacks. One of the primary ones is the absence of liquidity (or the family member problem in transforming a possession into money and cash money right into a property).

Real Estate Reno Nv for Beginners

Why spend in real estate? The truth is, there are several genuine estate benefits that make it such a preferred choice for skilled capitalists.

Equity is the worth you have in a residential or commercial property. Over time, routine repayments will ultimately leave you possessing a building cost-free and clear.

The Definitive Guide for Real Estate Reno Nv

Anybody who's gone shopping or loaded their container recently recognizes how rising cost of living can damage the power of hard-earned money. Among the most underrated genuine estate benefits is that, unlike many standard financial investments, property worth has a tendency to increase, even throughout times of noteworthy rising cost of living. Like other essential assets, genuine estate frequently keeps worth and can for that reason operate as an excellent location to spend while greater rates gnaw the gains of different other investments you may have.

Recognition describes cash made when the overall value of my company a possession increases in between the time you buy it and the time you market it. Genuine estate, this can suggest substantial gains as a result of the usually high rates of the possessions. It's vital to bear in mind recognition is an one-time point and only gives cash when you offer, not along the way.

As mentioned earlier, money flow is the cash that begins a monthly or yearly basis as a result of owning the building. Normally, this is what's left over after paying all the essential expenses like home loan settlements, repair services, taxes, and insurance policy. Some residential or commercial properties might have a significant capital, while others may have little or none.

3 Easy Facts About Real Estate Reno Nv Described

Brand-new capitalists may not genuinely recognize the power of leverage, but those that do open the capacity for massive gains on their financial investments. Typically talking, leverage in investing comes when you can possess or regulate a larger amount of assets than you might or else spend for, via making use of debt.